Discover the powerful features that make FundsXML the new benchmark for fund data in Europe.

Data Standardization

FundsXML provides a unified XML schema, ensuring that fund data is consistent and interoperable across all European markets. This eliminates ambiguity and reduces the need for costly data transformation processes.

Based on the robust and proven FundsXML framework.

Clear definitions for all data points and structures.

Reduces integration costs and operational risks.

Regulatory Compliance

Stay ahead of regulatory changes with built-in support for key European directives. FundsXML is designed to help you meet your obligations under ESAP, MiFID II, and other regulations with confidence.

Dedicated schemas for ESAP, EMT, EET, and EPT.

Continuously updated to reflect the latest regulatory landscape.

Simplifies compliance reporting and reduces audit risks.

Cross-Border Integration

Facilitate seamless data exchange across European countries and multiple jurisdictions. The standard is designed to handle regional variations while maintaining a consistent core structure.

Multi-language and multi-currency support.

Standardized format for cross-border fund distribution.

Breaks down data silos between different national markets.

Developer Friendly

Get up and running quickly with our comprehensive documentation and powerful validation tools. We provide everything developers need for a smooth and rapid implementation.

Extensive documentation with guides and examples.

Open-source libraries and tools on GitHub.

Community forum for support and collaboration.

Data Quality Assurance

Ensure the accuracy and consistency of your fund data with built-in validation and verification mechanisms. The schema includes rules and constraints that help prevent common errors and improve overall data integrity.

Strict data typing and format enforcement.

Official validation tools to check compliance.

Reduces reconciliation errors and improves data reliability.

Custom Data Fields

Extend the standard to fit your unique needs. FundsXML allows for the inclusion of user-defined fields, enabling you to embed proprietary data within the standard XML structure.

Utilize the `CustomDataFields` node for custom data points.

Maintain validation against the core schema while adding your own information.

Perfect for internal workflows or specific bilateral data agreements.

Digital Signature (XMLSig)

Ensure the authenticity and integrity of your data. FundsXML files can be digitally signed using the W3C XML Signature standard (XMLSig), providing a secure and verifiable data exchange.

Guarantees that the data has not been altered in transit.

Verifies the identity of the sender.

Provides legal non-repudiation.

Based on the open W3C standard for maximum interoperability.

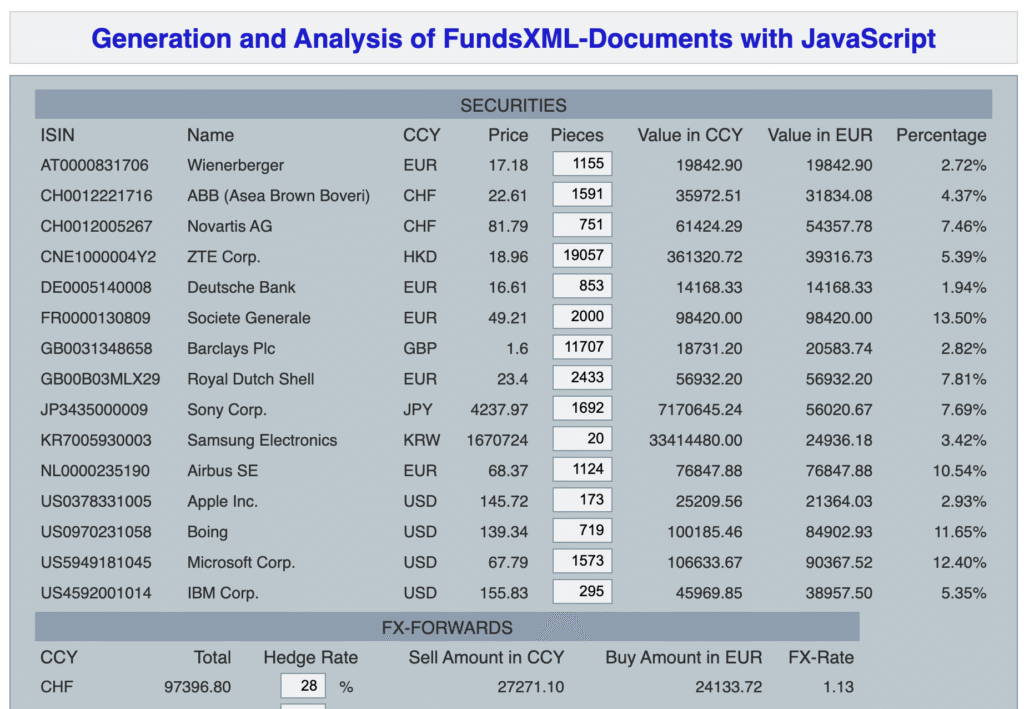

Comprehensive Portfolio Reporting

Model detailed portfolio holdings at any point in time. Include breakdowns by asset class, country, currency, or sector, providing a complete picture of a fund’s composition.

Strict data typing and format enforcement.

Official validation tools to check compliance.

Reduces reconciliation errors and improves data reliability.

Flexible Transaction Reporting

Standardize the reporting of all fund-related transactions. The schema supports a wide range of activities, from simple subscriptions and redemptions to complex corporate actions.

Covers subscriptions, redemptions, switches, and dividend payments.

Includes fields for trade dates, settlement dates, prices, and fees.

Improves STP rates for order processing.

Data Depth & Integrity

Unparalleled Data Coverage and Quality

FundsXML goes beyond simple data exchange. It provides a comprehensive and robust framework for the entire fund data lifecycle, ensuring accuracy and interoperability where other formats fall short.

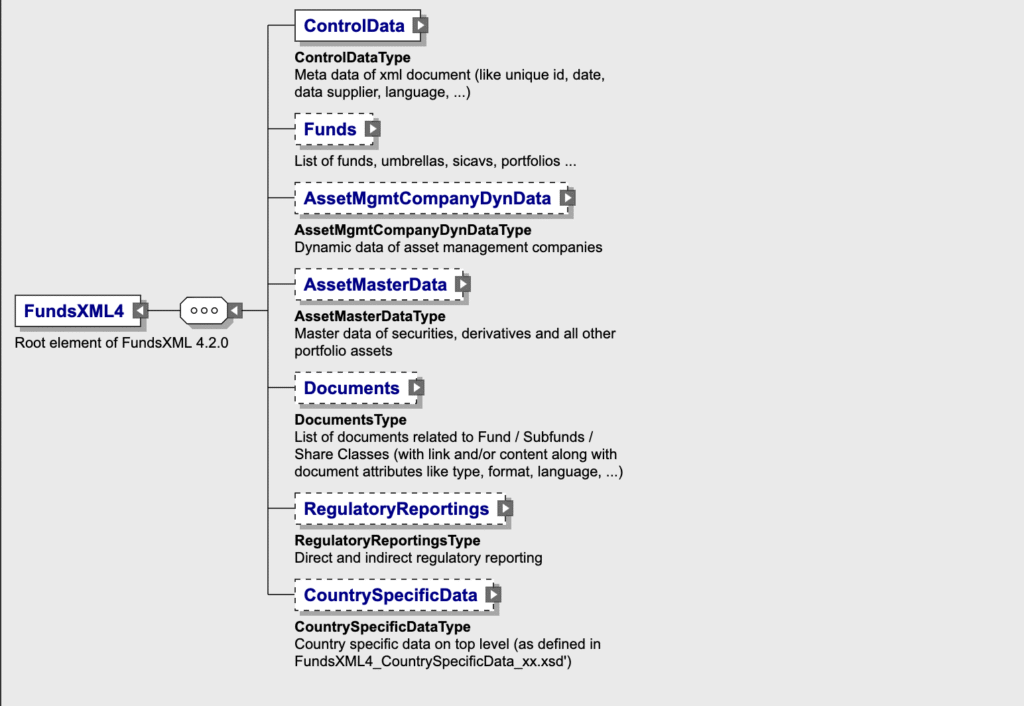

Comprehensive Data Scope

The standard supports a wide range of data types essential for the fund industry, allowing for a single, unified source of truth.

Fund Master Data (static and dynamic)

Portfolio Holdings and Breakdowns

Transaction and Order Data

Regulatory Reporting (ESAP, EET, etc.)

And much more…

Why XML with XSD is Superior to CSV

While CSV is simple, it lacks the structure and validation needed for complex financial data, leading to quality issues and integration challenges.

Strict Validation:

XSD schemas enforce data types and rules at the source, preventing errors common in CSV files.

Self-Describing:

XML tags provide context, making data human-readable and machine-understandable without external documentation.

Interoperability:

A standardized, validated schema ensures that data from one system can be seamlessly interpreted by another, eliminating ambiguity.

Tools & Resources

Leverage FundsXML Features with Our Tools

To help you take full advantage of FundsXML’s features for data standardization, regulatory compliance, and cross-border integration, we provide a suite of open-source tools to accelerate your implementation and work with the standard efficiently.

Online Schema Viewer

Browse and explore the FundsXML schema definitions in a user-friendly, interactive web interface

FundsXML Generator

Quickly create valid FundsXML files using a simple web interface

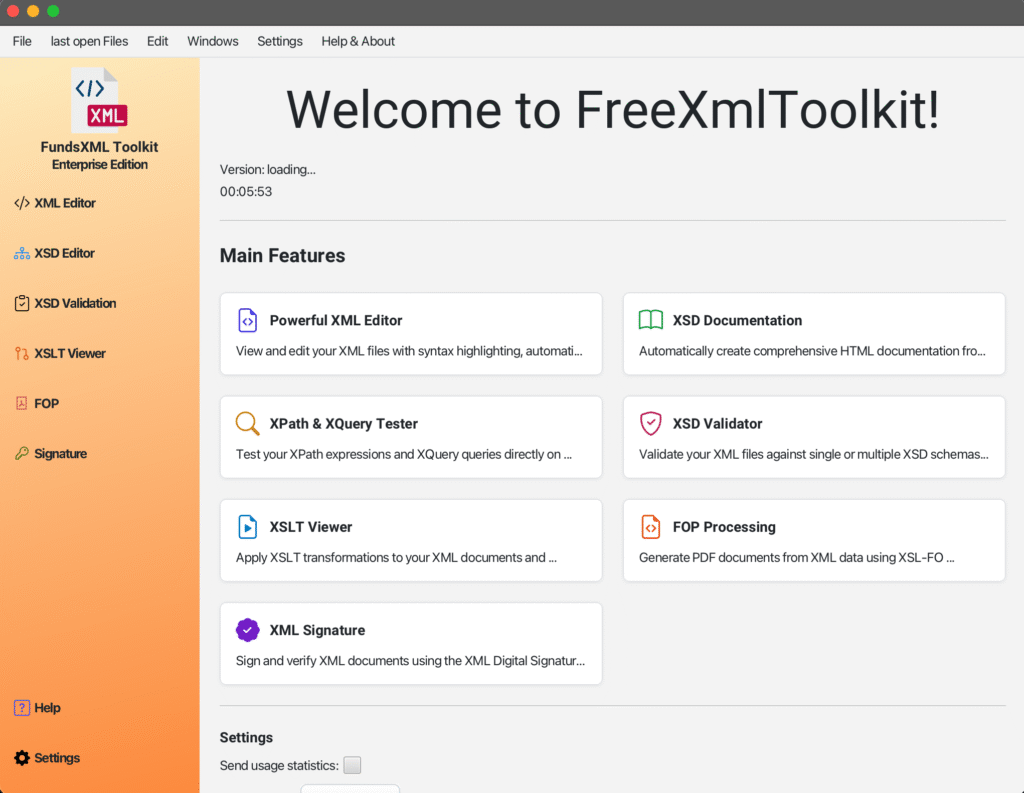

FreeXmlToolit

FreeXmlToolkit is a comprehensive application, offering tools to edit XML files both textually and graphically, and to visualize XSD schemas.

The application also supports a range of XML-related tasks, including documentation generation from XSD, XML validation, XSLT transformations, FOP processing, and digital signature management.